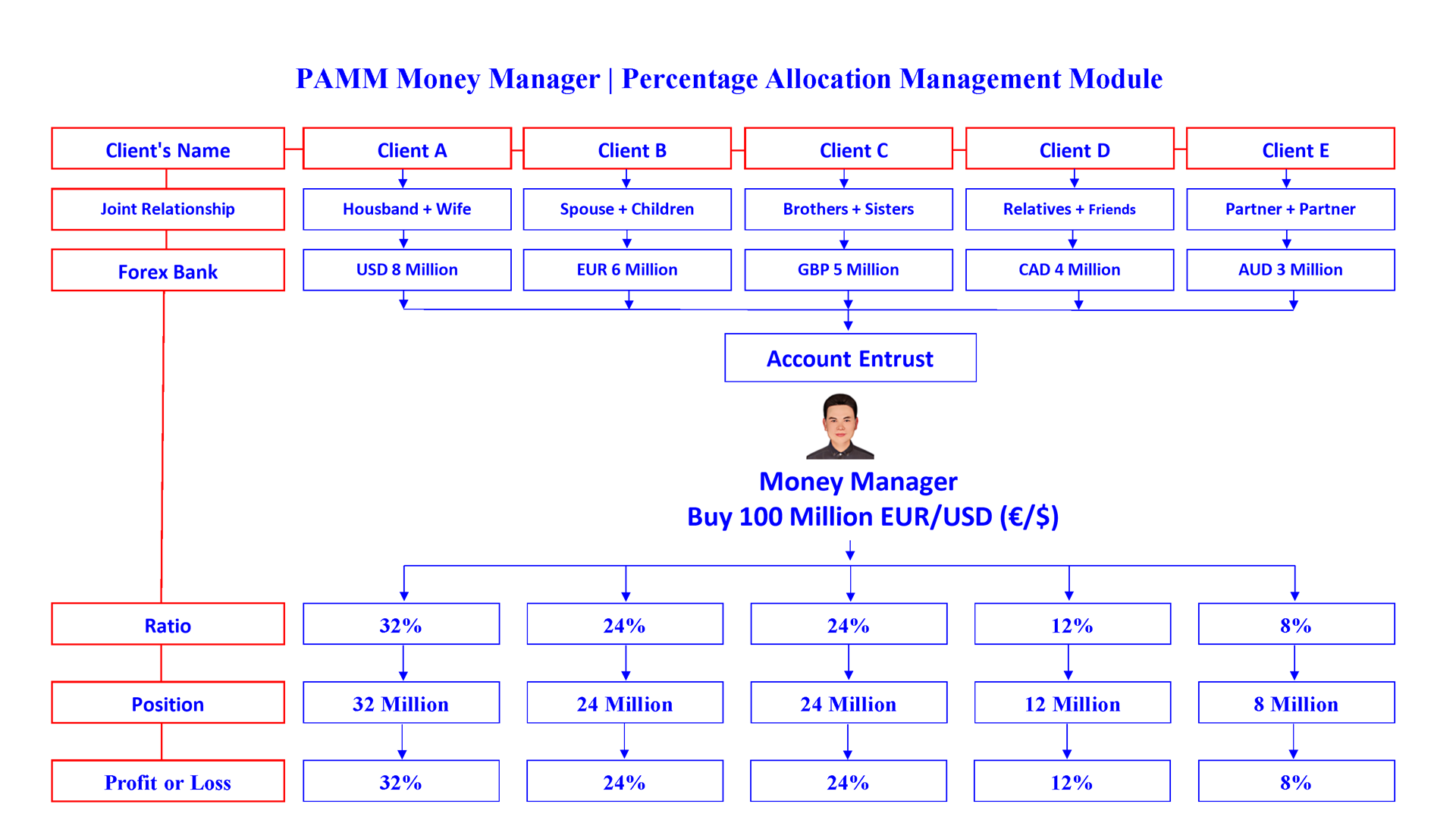

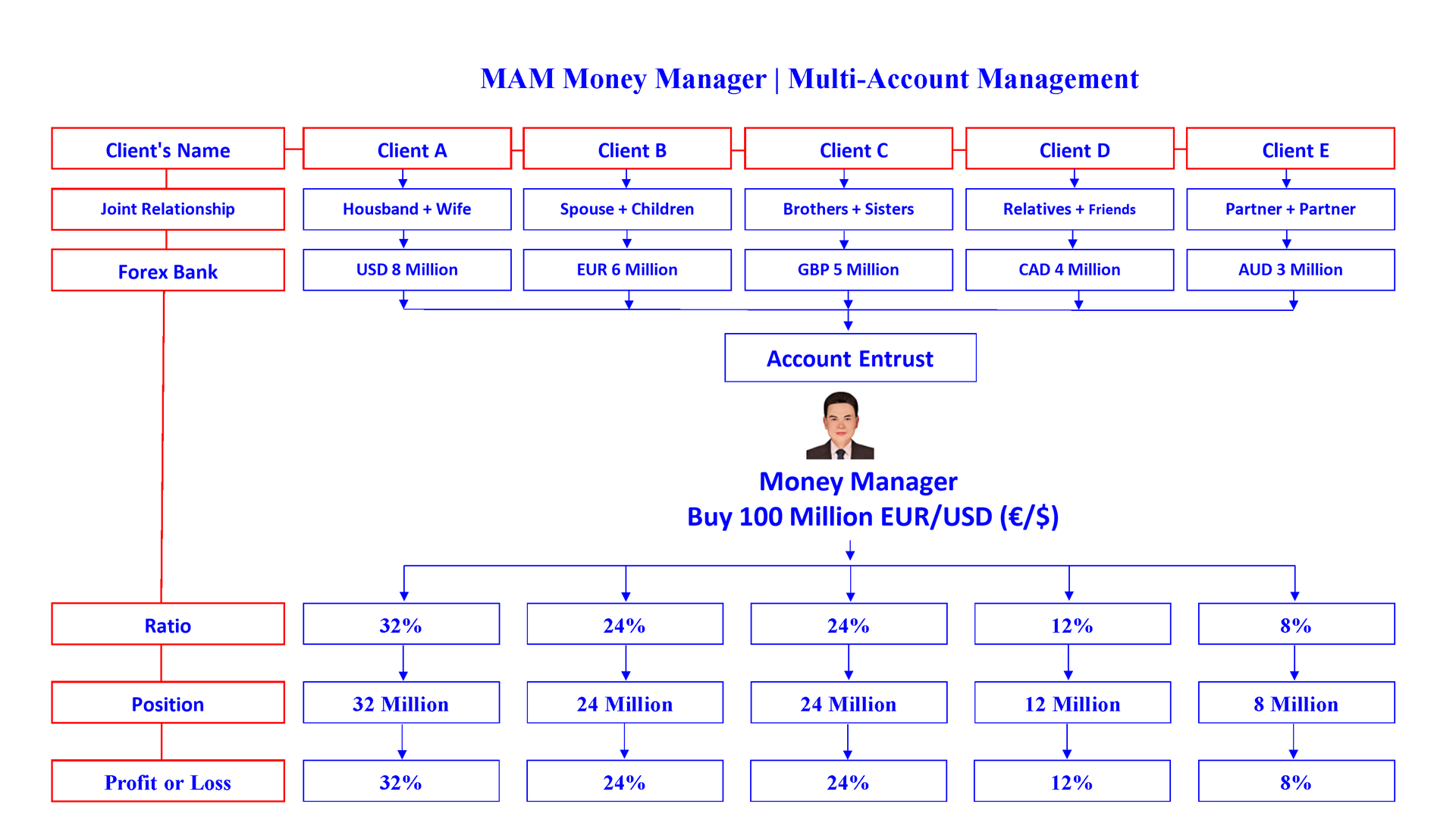

Accept global MAM & PAMM accounts entrusted trading!

Accept global forex prop firms real money accounts entrusted trading!

Accept real money account trading services from global asset management companies!

Accept real money account trading services from individuals with large personal funds around the world!

Account starts:Official at $500,000, trial at $50,000!

Profits shared half (50%) & losses shared quarter (25%)!

13711580480@139.com

13711580480@139.com

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

Mr. Zhang

Mr. Zhang

China · Guangzhou

China · Guangzhou