Trade for you! Trade for your account!

Invest for you! Invest for your account!

Direct | Joint | MAM | PAMM | LAMM | POA

Forex prop firm | Asset management company | Personal large funds.

Formal starting from $500,000, test starting from $50,000.

Profits are shared by half (50%), and losses are shared by a quarter (25%).

Forex multi-account manager Z-X-N

Accepts global forex account operation, investment, and trading

Assists family office investment and autonomous management

Foreign exchange investment manager Z-X-N accepts entrusted investment and trading for global foreign exchange investment accounts.

I am Z-X-N. Since 2000, I have been running a foreign trade manufacturing factory in Guangzhou, with products sold globally. Factory website: www.gosdar.com. In 2006, due to significant losses from entrusting investment business to international banks, I embarked on a self-taught journey in investment trading. After ten years of in-depth research, I now focus on foreign exchange trading and long-term investment business in London, Switzerland, Hong Kong, and other regions.

I possess core expertise in English application and web programming. During my early years running a factory, I successfully expanded overseas business through an online marketing system. After entering the investment field, I fully utilized my programming skills to complete comprehensive testing of various indicators for the MT4 trading system. Simultaneously, I conducted in-depth research by searching the official websites of major global banks and various professional materials in the foreign exchange field. Practical experience has proven that the only technical indicators with real-world application value are moving averages and candlestick charts. Effective trading methods focus on four core patterns: breakout buying, breakout selling, pullback buying, and pullback selling.

Based on nearly twenty years of practical experience in foreign exchange investment, I have summarized three core long-term strategies: First, when there are significant interest rate differentials between currencies, I employ a carry trade strategy; second, when currency prices are at historical highs or lows, I use large positions to buy at the top or bottom; third, when facing market volatility caused by currency crises or news speculation, I follow the principle of contrarian investing and enter the market in the opposite direction, achieving significant returns through swing trading or long-term holding.

Foreign exchange investment has significant advantages, primarily because if high leverage is strictly controlled or avoided, even if there are temporary misjudgments, significant losses are usually avoided. This is because currency prices tend to revert to their intrinsic value in the long run, allowing for the gradual recovery of temporary losses, and most global currencies possess this intrinsic value-reversion attribute.

Foreign Exchange Manager | Z-X-N | Detailed Introduction.

Starting in 1993, I leveraged my English proficiency to begin my career in Guangzhou. In 2000, utilizing my core strengths in English, website building, and online marketing, I founded a manufacturing company and began cross-border export business, with products sold globally.

In 2007, based on my substantial foreign exchange holdings, I shifted my career focus to the financial investment field, officially initiating systematic learning, in-depth research, and small-scale pilot trading in foreign exchange investment. In 2008, leveraging the resource advantages of the international financial market, I conducted large-scale, high-volume foreign exchange investment and trading business through financial institutions and foreign exchange banks in the UK, Switzerland, and Hong Kong.

In 2015, based on eight years of accumulated practical experience in foreign exchange investment, I officially launched a client foreign exchange account management, investment, and trading service, with a minimum account balance of US$500,000. For cautious and conservative clients, a trial investment account service is offered to facilitate their verification of my trading capabilities. The minimum investment for this type of account is $50,000.

Service Principles: I only provide agency management, investment, and trading services for clients' trading accounts; I do not directly hold client funds. Joint trading account partnerships are preferred.

Why did foreign exchange manager Z-X-N enter the field of foreign exchange investment?

My initial foray into financial investment stemmed from an urgent need to effectively allocate and preserve the value of idle foreign exchange funds. In 2000, I founded an export manufacturing company in Guangzhou, whose main products were marketed in Europe and the United States, and the business continued to grow steadily. However, due to China's then-current annual foreign exchange settlement quota of US$50,000 for individuals and enterprises, a large amount of US dollar funds accumulated in the company's account that could not be promptly repatriated.

To revitalize these hard-earned assets, around 2006, I entrusted some funds to a well-known international bank for wealth management. Unfortunately, the investment results were far below expectations—several structured products suffered serious losses, especially product number QDII0711 (i.e., "Merrill Lynch Focus Asia Structured Investment No. 2 Wealth Management Plan"), which ultimately lost nearly 70%, becoming a key turning point for me to switch to independent investment.

In 2008, as the Chinese government further strengthened its regulation of cross-border capital flows, a large amount of export revenue became stuck in the overseas banking system, unable to be smoothly repatriated. Faced with the reality of millions of dollars being tied up in overseas accounts for an extended period, I was forced to shift from passive wealth management to active management, and began systematically engaging in long-term foreign exchange investment. My investment cycle is typically three to five years, focusing on fundamental drivers and macroeconomic trend judgments, rather than short-term high-frequency or scalping trading.

This fund pool not only includes my personal capital but also integrates the overseas assets of several partners engaged in export trade who also faced the problem of capital being tied up. Based on this, I also actively seek cooperation with external investors who have a long-term vision and matching risk appetite. It is important to note that I do not directly hold or manage client funds, but rather provide professional account management, strategy execution, and asset operation services by authorizing the operation of clients' trading accounts, committed to helping clients achieve steady wealth growth under strict risk control.

Foreign Exchange Manager Z-X-N's Diversified Investment Strategy System.

I. Currency Hedging Strategy: Focusing on substantial currency exchange transactions, with long-term stable returns as the core objective. This strategy uses currency swaps as the core operational vehicle, constructing a long-term investment portfolio to achieve continuous and stable returns.

II. Carry Trade Strategy: Targeting significant interest rate differences between different currency pairs, this strategy implements arbitrage operations to maximize returns. The core of the strategy lies in fully exploring and realizing the continuous profit potential brought by interest rate differentials by holding the underlying currency pair for the long term.

III. Long Terms Extremes-Based Positioning Strategy: Based on historical currency price fluctuation cycles, this strategy implements large-scale capital intervention to buy at the top or bottom when prices reach historical extreme ranges (highs or lows). By holding positions long-term and waiting for prices to return to a reasonable range or for a trend to unfold, excess returns can be realized.

IV. Crisis & News-Driven Contrarian Strategy: This strategy employs a contrarian investment framework to address extreme market conditions such as currency crises and excessive speculation in the foreign exchange market. It encompasses diverse operational models including contrarian trading strategies, trend following, and long-term position holding, leveraging the amplified profit window of market volatility to achieve significant differentiated returns.

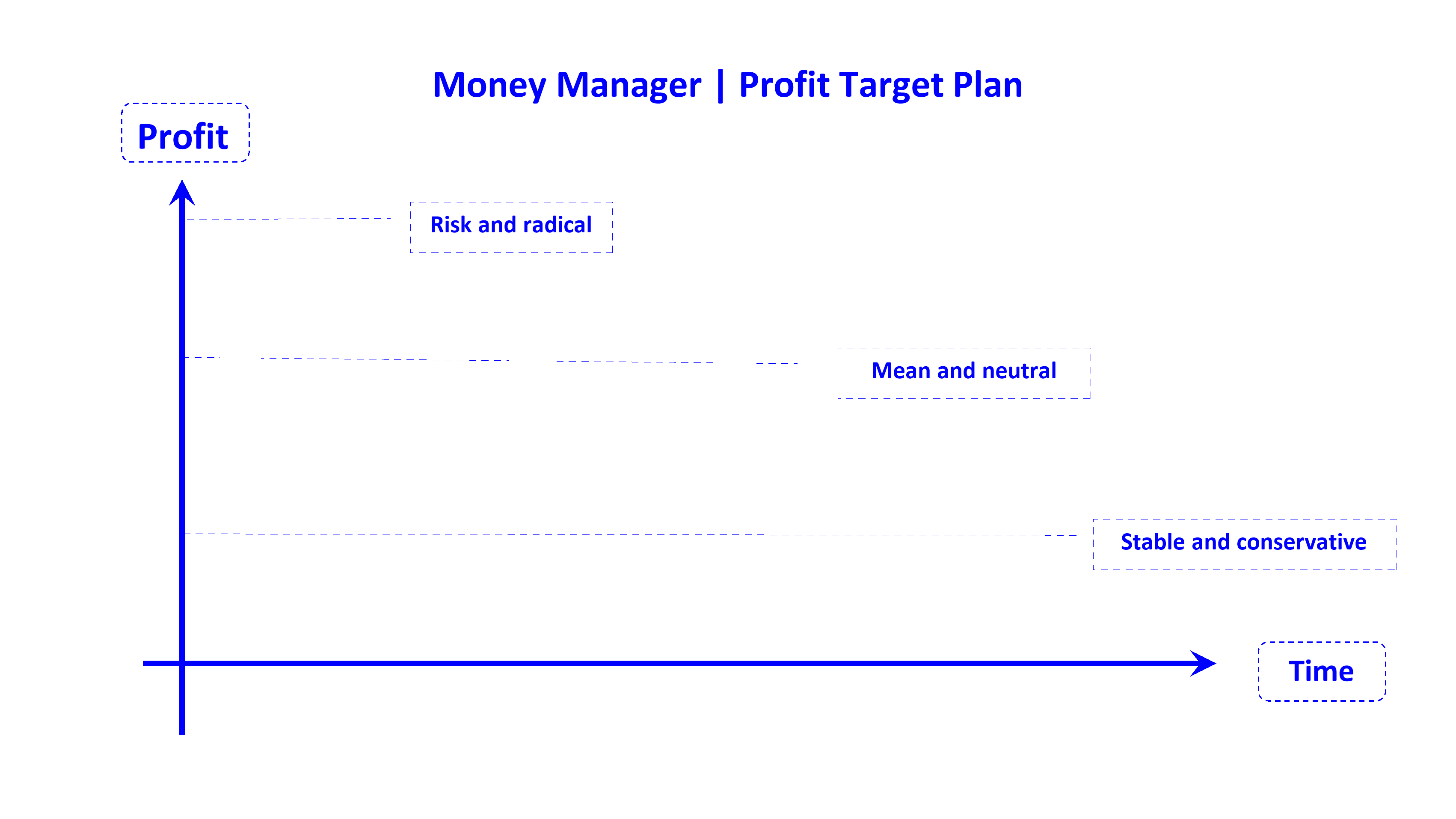

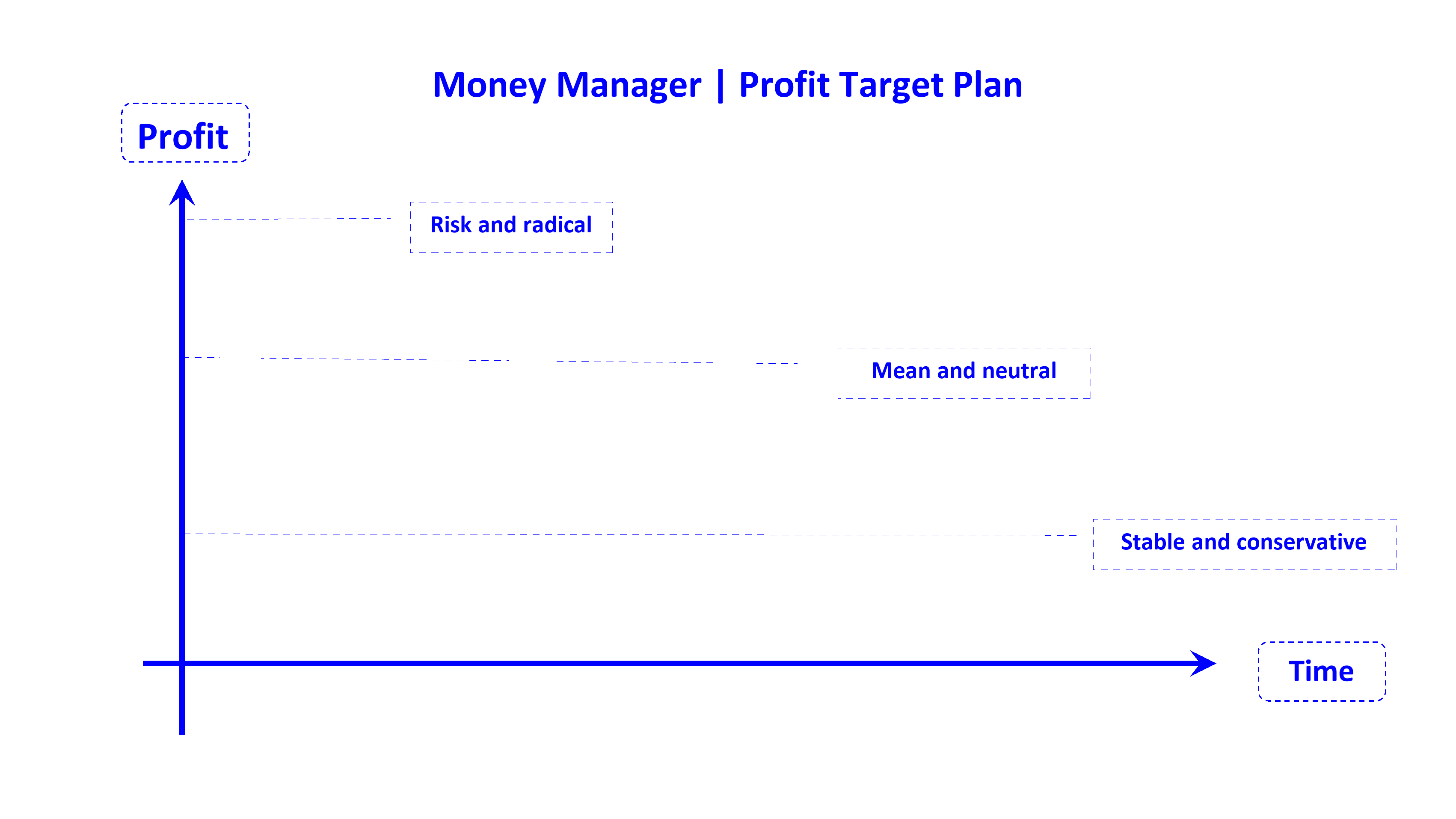

Profit and Loss Plan Explanation for Forex Manager Z-X-N

I. Profit and Loss Distribution Mechanism.

1. Profit Distribution: The forex manager is entitled to 50% of the profits. This distribution ratio is a reasonable return on the manager's professional competence and market timing ability.

2. Loss Sharing: The forex manager is responsible for 25% of the losses. This clause aims to strengthen the manager's decision-making prudence, restrain aggressive trading behavior, and reduce the risk of excessive losses.

II. Fee Collection Rules.

The forex manager only charges a performance fee and does not charge additional management fees or trading commissions. Performance Fee Calculation Rules: After deducting the current period's profit from the previous period's loss, the performance fee is calculated based on the actual profit. Example: If the first period has a 5% loss and the second period has a 25% profit, then the difference between the current period's profit and the previous period's loss (25% - 5% = 20%) will be used as the calculation base, from which the forex manager will collect the performance fee.

III. Trading Objectives and Profit Determination Method.

1. Trading Objectives: The forex manager's core trading objective is to achieve a conservative return rate, adhering to the principle of prudent trading and not pursuing short-term windfall profits.

2. Profit Determination: The final profit amount is determined comprehensively based on the market fluctuations and actual trading results for the year.

Forex Manager Z-X-N provides you with professional forex investment and trading services directly!

You directly provide your investment and trading account username and password, establishing a private direct entrustment relationship. This relationship is based on mutual trust.

Service Cooperation Model Description: After you provide your account information, I will directly conduct trading operations on your behalf. Profits will be split 50/50. If losses occur, I will bear 25% of the loss. Furthermore, you can choose or negotiate other cooperation agreement terms that conform to the principle of mutual benefit; the final decision on cooperation details rests with you.

Risk Protection Warning: Under this service model, we do not hold any of your funds; we only conduct trading operations through the account you provide, thus fundamentally avoiding the risk of fund security.

Joint Investment Trading Account Cooperation Model: You provide the funds, and I am responsible for the execution of trades, achieving professional division of labor, shared risk, and shared profits.

In this cooperation, both parties jointly open a joint trading account: you, as the investor, provide the operating capital, and I, as the trading manager, am responsible for professional investment operations. This model represents a mutually beneficial cooperative relationship established between natural persons based on full trust.

Account profit and risk arrangements are as follows: For profits, I will receive 50% as performance compensation; for losses, I will bear 25% of the losses. Specific cooperation terms can be negotiated and drafted according to your needs, and the final plan respects your decision.

During the cooperation period, all funds remain in the joint account. I only execute trading instructions and do not hold or safeguard funds, thereby completely avoiding the risk of fund security. We look forward to establishing a long-term, stable, and mutually trusting professional cooperation with you through this model.

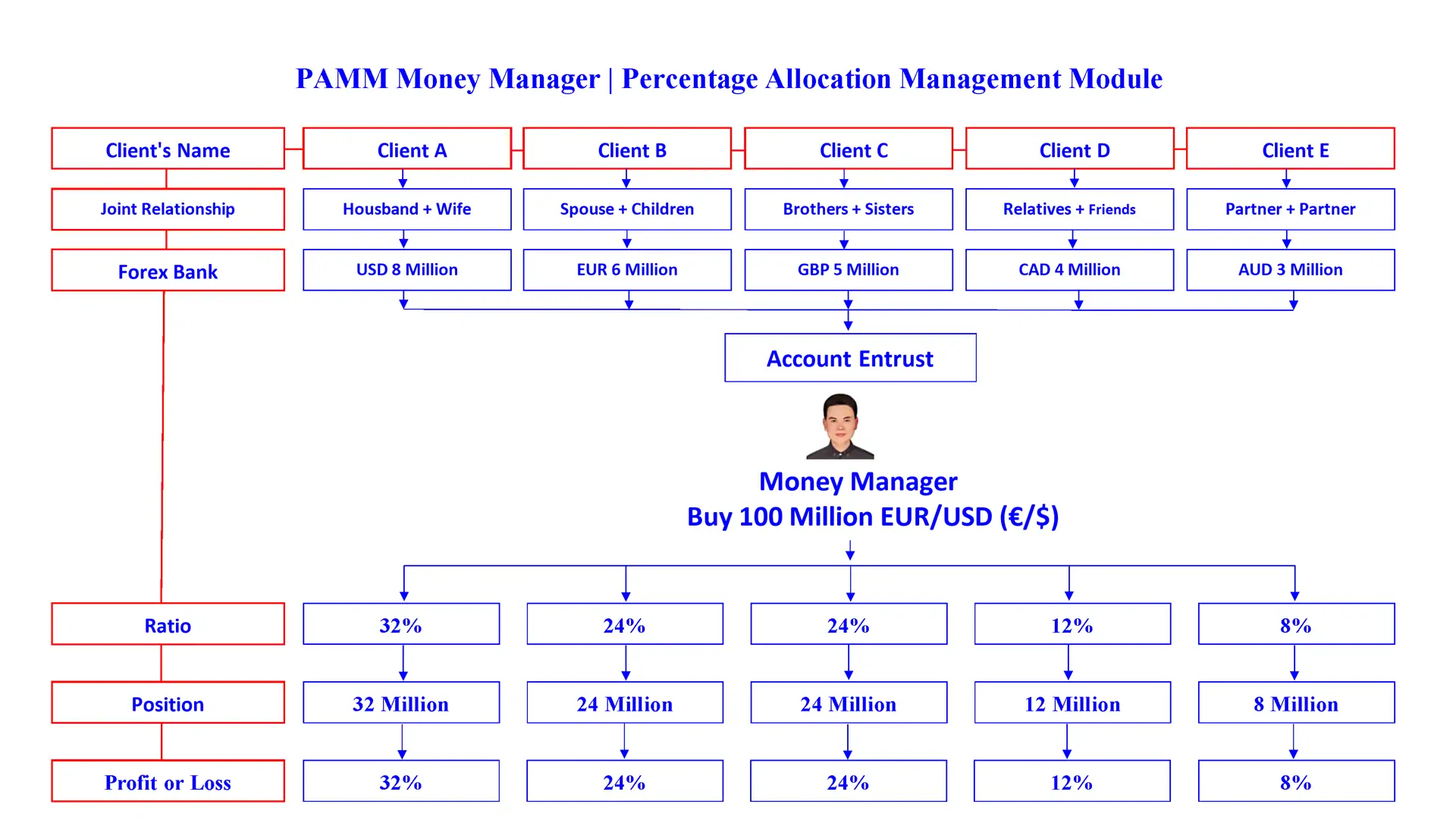

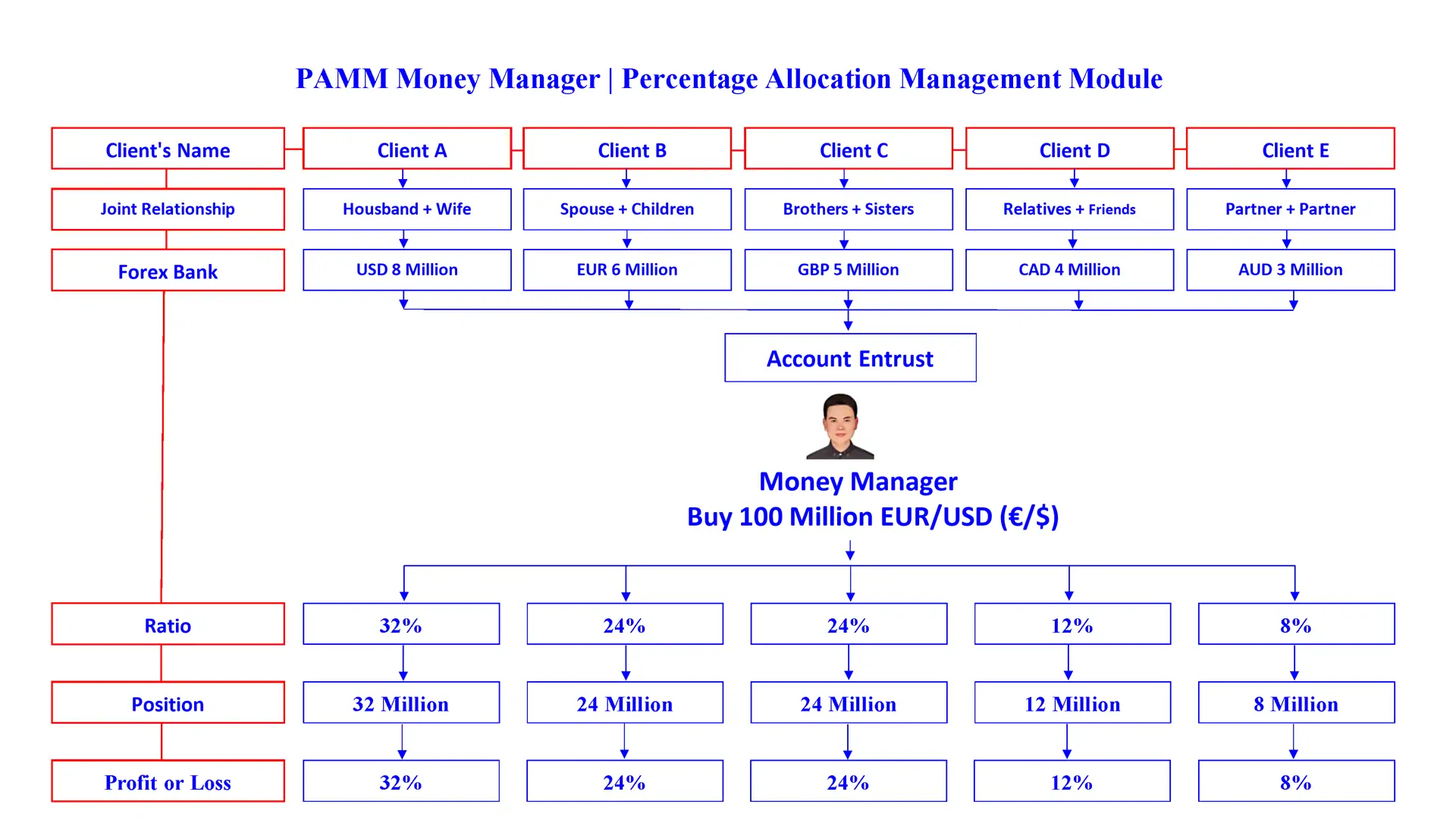

MAM, PAMM, LAMM, POA, and other account management models primarily provide professional investment and trading services for client accounts.

MAM (Multi-Account Management), PAMM (Percentage Allocation Management), LAMM (Lot Allocation Management), and POA (Power of Attorney) are all widely supported account management structures by major international forex brokers. These models allow clients to authorize professional traders to execute investment decisions on their behalf while retaining ownership of their funds. This is a mature, transparent, and regulated form of asset management.

If you entrust your account to us for investment and trading operations, the relevant cooperation terms are as follows: Profits will be split 50/50 between both parties, and this split will be included in the formal entrustment agreement issued by the forex broker. In the event of trading losses, we will bear 25% of the loss liability. This loss liability clause is beyond the scope of a standard brokerage entrustment agreement and must be clarified in a separate private cooperation agreement signed by both parties.

During this cooperation, we are only responsible for account transaction operations and will not access your account funds. This cooperation model has eliminated fund security risks from its operational mechanism.

Introduction to Account Custody Models such as MAM, PAMM, LAMM, and POA.

Clients need to entrust a forex manager to manage their trading accounts using custody models such as MAM, PAMM, LAMM, and POA. After the entrustment takes effect, the client's account will be officially included in the management system of the corresponding custody model.

Clients included in the MAM, PAMM, LAMM, and POA custody models can only log in to their account's read-only portal and have no right to execute any trading operations. The account's trading decision-making power is exercised uniformly by the entrusted forex manager.

The entrusted client has the right to terminate the account custody at any time and can withdraw their account from the MAM, PAMM, LAMM, and POA custody system managed by the forex manager. After the account withdrawal is completed, the client will regain full operational rights to their own account and can independently carry out trading-related operations.

We can undertake family fund management services through account custody models such as MAM, PAMM, LAMM, and POA.

If you intend to preserve and grow your family funds through forex investment, you must first select a trustworthy broker with compliant qualifications and open a personal trading account. After the account is opened, you can sign an agency trading agreement with us through the broker, entrusting us to conduct professional trading operations on your account; profit distribution will be automatically cleared and transferred by the trading platform system you selected.

Regarding fund security, the core logic is as follows: We only have trading operation rights for your trading account and do not directly control the account funds; at the same time, we give priority to accepting joint accounts. According to the general rules of the forex banking and brokerage industry, fund transfers are limited to the account holder and are strictly prohibited from being transferred to third parties. This rule is fundamentally different from the transfer regulations of ordinary commercial banks, ensuring fund security from a systemic perspective.

Our custody services cover all models: MAM, PAMM, LAMM, and POA. There are no restrictions on the source of custody accounts; any compliant trading platform that supports the above custody models can be seamlessly integrated for management.

Regarding the initial capital size of custody accounts, we recommend the following: Trial investment should start at no less than US$50,000; formal investment should start at no less than US$500,000.

Note: Joint accounts refer to trading accounts jointly held and owned by you and your spouse, children, relatives, etc. The core advantage of this type of account is that in the event of unforeseen circumstances, any account holder can legally and compliantly exercise their right to transfer funds, ensuring the safety and controllability of account rights.

Appendix: Over Two Decades of Practical Experience | Tens of Thousands of Original Research Articles Available for Reference.

Since shifting from foreign trade manufacturing to foreign exchange investment in 2007, I have gained a deep understanding of the operating essence of the foreign exchange market and the core logic of long-term investment through over a decade of intensive self-study, massive real-world verification, and systematic review.

Now, I am publishing tens of thousands of original research articles accumulated over more than two decades, fully presenting my decision-making logic, position management, and execution discipline under various market environments, allowing clients to objectively assess the robustness of my strategies and the consistency of long-term performance.

This knowledge base also provides a high-value learning path for beginners, helping them avoid common pitfalls, shorten trial-and-error cycles, and build rational and sustainable trading capabilities.

In forex trading, the experience shared by successful traders is not equally valuable to all market participants.

It is truly enlightening primarily for investors on the verge of a breakthrough—like a chick about to hatch, just needing the final push.

This kind of original, unique, and non-copy-pasted content, due to its high quality and scarcity, not only effectively attracts search engine crawling and indexing, thereby improving the visibility of related websites, but more importantly, it can provide just the right amount of assistance to traders who are close to cognitive awakening but lack key guidance.

For the vast majority of traders who have been consistently losing money, even when faced with the same advice, they often fail to grasp its deeper value due to fixed mindsets or cognitive blind spots; only those novices who have already gained initial awareness and urgently need external guidance to achieve a qualitative change can gain substantial inspiration and impetus from it, just as a midwife provides appropriate assistance during childbirth.

In the forex market, there is a fundamental difference between short-term traders who learn quickly and seasoned traders who have undergone long-term systematic training. This difference lies primarily in the depth of their knowledge and the proficiency of their practical skills, rather than simply in the trading timeframe.

Theoretical knowledge related to forex trading can be quickly acquired through systematic learning, covering core content such as the logic of exchange rate fluctuations, the characteristics of trading instruments, and fundamental analysis methods. However, the practical skills that truly support stable operation in a volatile two-way market, such as stop-loss execution, capital and position management, risk control, and the execution of market predictions, can only be gradually honed and developed through extensive targeted and intensive training. This is the core pain point in forex trading: "Theory is easy to learn, but mastering it in practice is difficult."

From a knowledge acquisition perspective, short-term learning only allows traders to gain a basic understanding of market rules and trading tools, failing to achieve a professional level of flexible application, and making it difficult to cope with the complex fluctuations in the foreign exchange market influenced by multiple factors such as macroeconomics and geopolitics. Long-term training, on the other hand, focuses on refining practical skills and improving overall trading capabilities. In fact, the core competencies in forex trading are essentially the same as those in other fields such as management and sales; breakthroughs require continuous training. There is no possibility of achieving professional trading skills solely through theory.

In traditional fields, international Olympic athletes undergo years of continuous training, practicing each technical movement tens or even hundreds of thousands of times to develop muscle memory and conditioned reflexes, ensuring precision during competition. This logic also applies to forex trading. Core trading execution actions, including precise stop-loss point control, reasonable capital allocation, emotional management during position holding, and emergency response to sudden market changes, all require thousands or tens of thousands of intensive training sessions to form instinctive, correct operating habits. Otherwise, in actual trading, repetitive errors such as hesitation in stop-loss orders, loss of position control, and chasing highs and lows are easily made, leading to trading losses.

Furthermore, error correction training is an indispensable core component of forex trading training. Its core purpose is to help traders abandon bad trading habits such as wishful thinking and arbitrary stop-loss orders through real-time error correction and repeated review during intensive training, strengthening standardized operations, strict risk control, and other correct trading actions, gradually forming a scientific trading logic. Ultimately, through extensive specialized training and continuous error correction and review, traders can not only effectively reduce human errors in the trading process but also solidify good trading habits, establish a mature risk control system, and thus achieve a steady improvement in overall trading capabilities. This fundamentally avoids the predicament of purely theoretical learning without practical application and timely error correction, resulting in "armchair theorizing" trading. It truly achieves a deep integration of theoretical knowledge and practical skills, adapting to the complex and volatile nature of the forex market.

In forex trading, knowledge that cannot be translated into effective execution is worthless—this is the root cause of the persistent losses of the vast majority of forex investors.

Many traders, while mastering the theory, struggle to put it into practice. The crux of the problem lies in the lack of systematic, intensive practical training. Relying solely on superficial understanding without extensive repetitive practice and the tempering of execution in real market environments means that so-called "knowing" remains merely cognitive and cannot be internalized into stable and reliable operational capabilities.

Furthermore, many traders lack a clear understanding of the core standards and logic behind their operations. For example, they lack clear and consistent execution guidelines for key aspects such as selecting trading targets, determining entry points, and scientifically setting stop-loss orders.

To truly bridge the gap between "knowing" and "doing," one must engage in hundreds or even thousands of deliberate practices, gradually building deep trust in their own trading system through repeated trial and error and review. Only in this way can one steadfastly execute trades in the face of market fluctuations and avoid interrupting operations due to self-doubt.

Otherwise, even if one learns the most advanced and comprehensive trading system, it will remain ineffective if it cannot be consistently and consistently executed.

In the field of two-way forex trading, while accurately judging market trends and grasping exchange rate fluctuation patterns are core competencies, even more crucial is establishing a clear self-awareness and recognizing one's own trading weaknesses and strengths.

Many forex traders have accumulated years of experience in the market, becoming adept at interpreting candlestick patterns, understanding fund flows and market sentiment trends, and even developing their own trading strategies and operational frameworks. However, in actual trading practice, they still struggle to escape losses. The core issue lies in insufficient execution.

Even with sound trading methods and mature systems, most traders fail to effectively implement their strategies in the actual stages of opening and closing positions, as well as setting stop-loss and take-profit orders. They either violate trading rules due to greed, blindly chasing highs and lows, or miss reasonable trading opportunities due to fear, exiting the market prematurely. Ultimately, this leads to a disconnect between trading strategies and actual execution, resulting in continuous losses.

When such practical losses and lack of execution occur, the trader's primary task is to stop blindly reviewing the market and hastily adjusting strategies. Instead, they should engage in deep self-reflection, examining whether they have spent enough time understanding and recognizing themselves during the trading process—self-awareness in forex trading hinges on the trader objectively assessing their trading capabilities and risk tolerance limits, clearly identifying their strengths and weaknesses in market analysis, risk management, and emotional regulation. They should not overestimate their control over the market, nor ignore their own operational loopholes. Only by first recognizing themselves can a mature trading system and methods be truly implemented, gradually improving the problem of insufficient execution, reducing practical losses, and achieving long-term stable operation in the forex two-way investment market.

In forex two-way investment trading, the choice of chart timeframe has a profound impact on the trader's decision-making.

Short-term traders often tend to use shorter timeframes, such as 1-minute, 5-minute, or 15-minute charts. While these timeframes can frequently present seemingly substantial entry and exit signals, they also introduce a significant amount of noise and false volatility, greatly increasing market temptations.

These seemingly enticing "opportunities" are often illusions created by short-term random fluctuations, lacking the continuity and stability of a trend. Essentially, the core trap in forex trading is not technical deficiencies or information asymmetry, but the pervasive temptation itself—traders mistakenly equating high-frequency volatility with genuine profit opportunities.

The shorter the timeframe, the more easily price action is influenced by market sentiment, liquidity disturbances, and short-term news events. While the number of "opportunities" presented may be greater, they often lack a solid trend foundation, leading to a lower win rate, higher transaction costs, and increased risks associated with emotional trading.

Therefore, traders must be aware that not all visible fluctuations constitute valid opportunities. The smaller the signal is in a cycle, the more carefully you need to identify whether it is embedded in a higher-level trend. Otherwise, you are very likely to fall into the "opportunity illusion", frequently stop loss, and ultimately damage your overall trading performance.

In the two-way forex market, most investors generally face the dilemma of "knowing is easy, doing is hard."

From mastering trading theory and clarifying trading logic to truly implementing it and forming stable operating habits, there is still a long path of advancement. The core prerequisite for this path is extensive real-world testing and repeated verification of one's own trading logic and operational strategies. Only by building absolute trust in the trading system through continuous positive feedback can the barrier of "knowing but not doing" be broken, achieving synchronization between cognition and execution.

The so-called "enlightenment" of forex traders is essentially a manifestation of a stage of maturity in trading cognition and operational ability. The most direct manifestation of this is having a complete trading methodology, being able to clearly define core operational standards such as entry, exit, profit-taking, and stop-loss in the complex and ever-changing forex market, avoiding blind trading and subjective judgment. A well-developed trading system is also a core hallmark of "enlightenment." A scientifically sound, compliant forex trading system tailored to one's trading style standardizes the trading process, clarifies operational logic, helps investors avoid emotional interference, and ensures that every two-way trade is traceable and reviewable, laying the foundation for continuous operation.

Simultaneously, strong trading capabilities are also a crucial manifestation of "enlightenment." These capabilities encompass not only accurate analysis of exchange rate fluctuation patterns and macroeconomic data (such as interest rates, inflation, and geopolitical factors influencing forex trends), but also risk control and money management abilities. Ultimately, this translates into long-term, stable, and positive profits in the forex market, which is the core understanding of "enlightenment" held by most forex investors.

However, it's important to clarify that "enlightenment" in forex trading is not the end goal. Essentially, it simply means that the investor has found the right trading direction that aligns with the forex market's rules and suits their own circumstances. From "enlightenment" to "proof," and then to forming a stable profit model and achieving continuous capital appreciation, investors still need to continuously review, optimize, and iterate in live trading, constantly bridging the gap between cognition and execution, theory and practice. This subsequent advancement process also requires sufficient patience, professionalism, and execution.

For forex traders, "enlightenment" is not the end goal, but rather the beginning of the path to mature trading.

In two-way forex trading, once traders truly understand and deeply grasp the overall structure of the forex market, all the basic knowledge, core trading skills, and key elements of behavioral finance and psychology, achieving profitability is often just the starting point of long-term accumulation. So-called "enlightenment" in trading is not the end goal, but rather the beginning of the path to mature trading.

However, many forex traders have a common misunderstanding about "enlightenment": they mistakenly believe that once they achieve a sudden insight or cognitive breakthrough, they can immediately achieve consistent and stable profits in the market, even making a living from it. The essence of this misconception lies in equating a fleeting moment of inspiration or directional awakening during trading with long-term, stable profitability.

In reality, the true meaning of "enlightenment" lies in establishing direction—that is, after repeated practice and reflection, the trader suddenly clarifies their trading logic, strategic framework, and risk boundaries, forming a clear and market-compliant understanding of future trading paths. But it must be clearly recognized that there is still a significant gap between having the right direction and possessing the actual ability to execute profitable trades. From cognition to action, from execution to results, systematic training, discipline, money management skills, and the ability to continuously adapt to market fluctuations are required. Only by bridging this gap can traders truly transform "enlightenment" into "profit."

In the field of two-way forex trading, true practitioners never pursue the goal of "capturing every wave of profit." Those who promote such views are often not front-line traders, but rather practitioners engaged in theoretical research, book writing, or trading training. Their statements are mostly based on idealized assumptions, detached from the real-time fluctuations of the forex market.

For forex traders, the core of a scientific trading philosophy lies in abandoning the pursuit of extremes. Attempting to continuously profit from the top to the bottom of a market is purely unrealistic. After all, the forex market is influenced by multiple factors such as macroeconomics, geopolitics, and liquidity, making market movements highly unpredictable. No one can accurately predict future market trends. Therefore, traders do not need to strive to capture every market movement. The focus should be on the core range within the overall market movement with the highest probability of success and profitability, concentrating on high-certainty opportunities rather than blindly chasing all fluctuations.

In actual trading, forex traders often face the dilemma of difficulty in defining the nature of market trends, specifically whether the current trend is a rebound or a reversal. This uncertainty is an inherent characteristic of the forex market and a core challenge that traders must confront. The rational approach is to wait for a clear reversal signal before entering the market, proactively abandoning the uncertainties of the initial stage of a trend, rather than blindly following the crowd.

Furthermore, after entering a position, traders must consider subsequent market liquidity when formulating exit strategies, reserving reasonable profit margins for potential buyers. Excessively pursuing maximum profit at the expense of subsequent market opportunities often leads to difficulties in exiting and realizing profits smoothly.

In addition, the core profit logic of forex trading lies in focusing on market advantages within one's circle of competence. Compared to market trends with low certainty and high uncertainty, well-confirmed, high-certainty market trends not only offer higher profit stability but also tend to have greater profit potential, helping traders achieve more efficient profit accumulation. This is a core practical principle for mature forex traders.

In forex trading, the fundamental reason why many traders "know but don't act" lies in a lack of confidence and conviction.

This lack of confidence doesn't arise out of thin air; it stems from traders' failure to conduct sufficient, systematic, and extensive testing, verification, and validation of their trading logic, strategies, and information sources. True trading confidence isn't built on subjective assumptions or short-term experience, but rather on probabilistic cognition gradually accumulated through repeated practice and data backtesting.

In forex trading, all valid information sources and decision-making bases must be tested against extensive historical data and live trading. Only in this way can traders extract statistically significant probabilistic advantages. The quantity and quality of information directly determine the reliability of a strategy—the sample size for testing and validation cannot be too small. Only through sufficient trading and review can traders develop clear probabilistic thinking and use it as the core foundation for trading decisions.

Based on this probabilistic understanding, traders should adopt differentiated decision-making strategies: when a trade has a low win rate and lacks statistical support, even if the opportunity seems tempting, it should be decisively abandoned; conversely, when a trading signal shows a high probability of success and is highly consistent with the current market trend, it should be executed boldly, actively trying and failing. This discipline of "high-probability attack, low-probability avoidance" is the key difference between professional forex traders and ordinary investors.

In the two-way forex trading market, for every forex investor, being able to trade with peace of mind is essentially the essence of sustainable successful trading.

Maintaining a consistently calm investment logic and operational rhythm is one of the core benchmarks for measuring the success of investment behavior in the forex investment field. This core logic runs through the entire forex trading process, deeply integrated with key trading aspects such as currency pair selection, position management, and risk control. It is also the core prerequisite for forex investors to achieve long-term, stable profits in a volatile market with alternating bullish and bearish trends.

True peace of mind in forex trading doesn't mean blindly ignoring market fluctuations or recklessly avoiding trading risks. Rather, it means maintaining a stable trading rhythm regardless of the chosen mainstream or cross-currency pair—whether it's a highly liquid pair like EUR/USD or GBP/JPY, or a less volatile niche pair; and regardless of the position size strategy—whether using small initial positions, medium-sized positions, or large positions for speculation—while adhering to pre-set risk control limits. It means not letting short-term market fluctuations disrupt the trading plan, and not experiencing excessive emotional swings due to the profit or loss of a single trade. It means maintaining a normal lifestyle, eating well, sleeping soundly, and freeing oneself from anxiety and fear of loss. Behind this peace of mind lies complete trust in one's trading system, a rational understanding of market dynamics, and a precise control over the balance between risk and return.

Conversely, in two-way forex trading, any trade that fails to give investors peace of mind, even if it yields occasional short-term profits, is a failed trade from a long-term trading perspective. Furthermore, investment behavior that fails to maintain peace of mind violates the core principles of forex investment. Such trades are often accompanied by investors blindly following market trends, losing control of position management, and crossing risk thresholds. Ultimately, they either trade frequently due to excessive anxiety, chasing highs and lows, or ignore potential risks due to wishful thinking, leading to trading losses and even a cycle of continuous losses. This is the core issue preventing most forex investors from achieving long-term profitability.

In the field of forex trading, success is not merely a direct transfer of skills and experience.

For novice and average investors, even if they master the methods and techniques used by successful forex traders, it is difficult to replicate their success. This is mainly because mindset and accumulated experience are far more important than mere technical skills. Long-term investors may hold positions for years, while novices or average investors often struggle to maintain positions for more than a few days. Lacking the experience and patience for long-term holding, they naturally miss out on the profit opportunities that come from trends validated over time.

The key to success in forex trading lies in understanding the fundamental differences between oneself and successful investors, not simply imitating methods and strategies. Many forex investors mistakenly believe that simply understanding certain trading techniques or strategies guarantees profits. In reality, successful forex trading requires not only the right methods but also personal qualities, market insight, and an attitude towards risk. Even knowing the strategies of the world's top forex traders, ordinary investors without the corresponding psychological qualities and market understanding cannot succeed solely through these strategies.

Therefore, for investors hoping to succeed in the forex market, the first step is to recognize the importance of self-improvement—striving to acquire the qualities and conditions of successful investors, rather than simply focusing on external trading methods. Simultaneously, it's crucial to be aware of cognitive biases. Many investors frequently suffer losses in practice due to insufficient understanding of the difference between success and failure. This failure often stems from a failure to fully comprehend abstract yet vital market principles and the role of personal psychological factors, which are precisely the key differentiators of success and failure. In short, to succeed in the forex market, besides learning specific investment strategies, it's necessary to constantly examine and adjust one's mindset and behavioral patterns to adapt to market changes.

In the two-way forex trading market, one of the core principles for traders is to hold positions in currency pairs with potential volatility and profit potential and continuously participate in trading.

If you deviate from the market trading rhythm and interrupt position holding, you will be directly excluded from the market cycle when key market movements begin or trends form, missing crucial trading opportunities.

The core value of forex trading lies in the inherent uncertainty of every currency pair's fluctuations and every trading order. It could be a trading opportunity aligned with market trends, promising positive returns, or it could be a trading trap fraught with market volatility and hidden risks of loss. "Not participating in trading" often becomes the biggest loss for traders, as it means missing not only a single profit opportunity but also the potential for compound growth within a long-term market trend.

It's important to note that if traders choose not to trade out of fear of loss, even if they temporarily avoid short-term losses, they will completely miss the opportunity to enter the market when a trend emerges and the currency pair exhibits a clear one-sided movement. The potential profit loss is often far greater than the possible short-term loss.

Forex traders, the initial operating phase should adhere to the principle of small position entry. Active trading allows the market to provide real signals and validate trading decisions, rather than blindly observing. When the market clearly presents trading opportunities and the currency pair's movement aligns with expectations, positions can be gradually increased. Based on the analysis of market trends, deep holding and long-term positioning can be achieved to maximize the value of market movements.

In two-way forex trading, a trader's willpower is an extremely scarce and crucial resource, its importance even surpassing the size of their capital.

The forex market is highly volatile, information-saturated, and frequently subject to emotional interference. Without unwavering mental fortitude, even with ample capital and proficient technical analysis skills, significant losses can easily result from wavering confidence and emotional outbursts. Therefore, traders should consciously distance themselves from potentially negative emotional circles to avoid unnecessarily depleting their already limited psychological energy—continuous emotional drain quickly leads to mental exhaustion, inaccurate decision-making, decreased execution, and ultimately erosion of trading performance.

From a higher perspective, truly efficient wealth creation often follows a three-tiered structure of "mental strength—brainpower—physical strength." Manual labor is the most basic way of making a living, relying on direct input of time and body; mental labor creates value through knowledge, logic, and strategy, and is the main source of income for the middle class; while the wealth-creation model driven by mental strength represents the highest level of capability—it integrates belief, composure, vision, and foresight, and is the core competitiveness of outstanding figures such as entrepreneurs, politicians, and military leaders. The effect of mental strength is ten times that of mental strength; and the effect of mental strength is ten times that of physical strength. Those with abundant mental strength can remain clear-headed in chaos, uphold discipline under pressure, and seize opportunities in adversity.

For forex traders, mental strength is the fundamental force for navigating market uncertainty. It not only determines whether a trading plan can be strictly executed, but also whether one can remain rational after consecutive losses and restrain greed in the face of huge unrealized profits. It can be said that mental strength is the underlying pillar of long-term stable profitability, and its value far exceeds the number of funds in the account.

In the two-way forex market, a trader's core strategy essentially manifests as the unwavering ability to hold positions and the long-term resolve they possess after accurately judging market trends and selecting the correct trading direction.

This strategy is not blind adherence, but rather based on a deep understanding of the core drivers of forex markets, such as macroeconomic cycles, exchange rate fluctuations, and geopolitical influences. It is a composed and determined approach after rational analysis, not unfounded, reckless trading.

In actual trading, exchange rate fluctuations inherently possess uncertainty. Even if the directional judgment is correct, reasonable drawdowns and temporary floating losses during the holding period are normal market occurrences. This is a normal phenomenon in the forex market influenced by multiple variables. At this time, truly strategic traders will not be misled by the narrow-range stop-loss concept prevalent in short-term trading, nor will they waver in their holding decisions due to short-term fluctuations. They will consistently adhere to their established trading strategies, unaffected by short-term noise. This unwavering commitment to long-term trends, unburdened by temporary gains or losses, is the most core and rarest quality in forex trading.

For long-term forex investors, their overall perspective is crucial to the ultimate success or failure of their trades. Long-term holdings often span several years, during which they experience multiple rounds of exchange rate fluctuations and repeated short-term trend maneuvers. The key to investors who truly navigate these cycles and achieve long-term profitability lies in maintaining a clear understanding, avoiding being brainwashed by the narrow stop-loss mentality of short-term trading, and not getting caught up in the emotional turmoil of short-term profits or losses. They always prioritize long-term trends, adhering to their own trading logic and holding strategies. This understanding and composure—transcending short-term fluctuations and focusing on long-term value—constitutes the core competitiveness of long-term forex investors and is the core perspective that determines their ultimate trading fate.

In the field of two-way forex trading, truly talented traders are essentially pure and natural individuals.

They are not interested in studying fashion, not out of poverty or frugality, but because they deeply understand that such matters do not contribute to trading and are purely a waste of time. This doesn't mean they don't know how to enjoy life, but rather that after long immersion in the market, they've become accustomed to seeing through appearances to the essence—anything unrelated to value investing, such as buying luxury cars, pursuing gourmet food, or being particular about clothing, is seen as redundant, unnecessary, and meaningless. Over time, their lifestyle becomes extremely minimalist, even simplifying or abandoning complex interpersonal relationships.

The core driving force of gifted forex traders is not money itself, nor worldly pleasures, but a deep focus and continuous exploration of trading logic, market structure, and the laws of numerical growth. Because of this, their behavior often differs greatly from ordinary people, even being seen as "eccentric" by outsiders. In their early stages, they often experience extreme hardship and psychological trials—the market is ruthless, losses are ever-present, and their beliefs are repeatedly tested. However, once they overcome this darkest period, they no longer yearn for worldly pleasures; on the contrary, those noisy and glamorous things are seen as distractions and burdens, adding only to their anxieties. At this point, the trader truly enters a state of clarity, focus, and high self-discipline, practicing their understanding and respect for the essence of the market in the simplest way.

In the field of two-way forex trading, the primary prerequisite for traders suitable for value investing is having substantial capital and a stable, balanced trading mindset.

From a practical perspective, when capital is limited, it's advisable to focus on flexible trading to gain experience. However, once capital reaches a certain scale, shifting to value investing is a more prudent choice. Only traders who truly understand the core of value investing and possess the corresponding capital and mindset are suitable for practicing forex value investing.

The core quality for forex traders practicing value investing lies in accepting the investment logic of "getting rich slowly." This is also the most crucial characteristic for adapting to value investing. In reality, most traders struggle with value investing because they cannot relinquish their pursuit of quick profits and lack the patience for long-term gains. Forex traders with the ability to delay gratification are often better aligned with the underlying logic of value investing. These traders, who can actively resist short-term market temptations and adhere to the principle of delayed gratification, typically achieve more stable and higher-quality trading performance in two-way forex trading.

From an adaptation perspective, forex traders adapting to value investing fall into two main categories: those naturally endowed with the trait of delayed gratification can more quickly and smoothly understand and implement the trading logic and rhythm of value investing; while those lacking this trait can gradually cultivate the mindset and ability to adapt to value investing through systematic professional learning, continuous trading practice, continuous improvement in cognitive level, and gradual accumulation of market experience, thus successfully entering the field of forex value investing.

In the field of two-way forex trading, investors first need to deeply understand their own personality traits.

If you are unsure of your personality type, you can take a personality test to help identify it. Using a method similar to the Enneagram can help classify and understand your personality characteristics. This is crucial for determining whether you are suitable for speculative trading.

Key traits of successful forex investors include self-discipline, execution ability, and resilience and recovery from adversity. Self-discipline is considered the most important, as it is built upon a firm belief in one's trading strategy. A disciplined investor can remain calm even in the face of consecutive losses because they understand that every trade is based on probability, and consecutive profits or losses are manifestations of market randomness; breaking even is the norm.

Execution is another key element. It refers to the ability to efficiently complete assigned tasks, although this may require some degree of external supervision. Unlike self-discipline, execution emphasizes the ability to operate precisely according to established standards.

Finally, for any investor hoping to succeed in the forex market, the ability to quickly recover from setbacks and re-enter the market is essential. This means being able to quickly adjust one's mindset after experiencing consecutive stop-losses, forget past failures, and return to the market with renewed enthusiasm and energy. This ability to self-correct and bounce back is one of the key factors for long-term success. In conclusion, understanding oneself through personality analysis and cultivating these key qualities is crucial for forex investors.

In two-way forex trading, the trader's core investment advantage lies in the extremely high stability of currency value.

Foreign exchange prices consistently fluctuate within their intrinsic value range, avoiding drastic one-sided price movements. This ensures that there are no extreme profits or losses in forex trading, keeping both risk and return relatively controllable. Compared to the stock market where junk stocks are common, while theoretically "junk currencies" with extremely low credit ratings and poor liquidity exist in the forex market, their numbers are extremely limited. Furthermore, due to the strict screening and entry standards of forex trading platforms, "junk currencies" cannot enter legitimate trading channels. Even if traders intend to invest in these currencies, they have no operational space, further reducing the overall risk of forex trading.

Success in any field essentially involves discovering, mastering, and flexibly applying its inherent laws. Forex investment is no exception. The dialectical relationship between price and value is the eternal and most fundamental core law in forex trading. If this core law fails, forex trading itself loses its foundation, and traders cannot conduct investment activities.

Forex traders must first deeply understand this core principle: currency prices are determined by their intrinsic value, and prices always fluctuate around this value. This is the underlying logic of forex trading. In actual trading, applying this value principle is the only eternally effective trading method in the investment market. Specifically, it means decisively buying when the currency price is below its intrinsic value (undervalued) and selling promptly when the currency price is above its intrinsic value (overvalued).

For ordinary forex investors, as long as they deeply understand and consistently apply this core principle in their trading, their long-term investment career will inevitably achieve steady profits and success.

In two-way forex trading, "knowing but not doing" is a common problem for most traders and the root cause of continuous losses.

This dilemma not only reflects a deviation from trading discipline but also deeply reflects the unique challenges faced by speculative trading and value investing: extremely limited margin for error, extremely high requirements for execution, and the psychological pain often associated with stop-loss orders. Traders often need to endure long periods of holding positions, and even persist in betting on the continuation of a trend while being trapped in a losing position. This poses a severe test to their psychological resilience and behavioral consistency.

The difficulty of short-term trading lies not in the complexity of the methods themselves, but in whether traders can truly believe in and steadfastly execute the learned strategies. Any technical analysis tool or trading system has its limitations and timeliness—it is sometimes effective, sometimes ineffective, and may even fail repeatedly, leading to frequent stop-losses and shaking the trader's confidence. Even with a proven quantitative trading system, very few people can consistently and strictly adhere to it; traders who can maintain a 100% execution rate over the long term are even rarer, one in a hundred, one in a thousand.

From an investment perspective, when a systematic approach is lacking, building an effective method is undoubtedly the primary task; however, once the method is established, the real key shifts to execution—that is, the ability to translate knowledge into consistent and stable behavior. Therefore, the core problem for forex traders ultimately lies in the "knowing-doing gap": in the investment world, "knowing but not doing" is the most intractable ailment and the key dividing line between ordinary and mature traders.

In the two-way forex market, traders with independent trading logic and contrarian thinking will not fall into the trap of continuous losses.

Traders who blindly follow the crowd and engage in the same practices as the majority of market participants—those who are fearful when others are fearful and greedy when others are greedy—often remain in a state of long-term losses. This is a typical predicament for most retail investors in the forex market. Conversely, maverick forex traders consistently adhere to the principle of contrarian trading. They decisively enter the market when panic spreads and most participants sell off, and rationally exit when the market is overheated and most participants blindly chase highs and add to their positions. Even if these traders experience short-term losses, it is merely a temporary market adjustment. In the long run, they will weather market cycles and become one of the few successful traders.

In the forex market, participants who trade based on human instinct are highly likely to become part of the more than 90% of the losing group, especially during periods of strong trending markets. Most traders do not enter the market based on a profit-making logic, and instead become the last ones holding the bag at the end of the trend. This phenomenon is particularly evident during periods of sustained forex market booms.

When a currency pair in the forex market experiences a sustained surge in popularity, the profit-making effect spreads rapidly. Influenced by the profitable atmosphere around them, many traders often ignore key judgment factors such as market valuation and trend continuation, blindly rushing into the market. Simultaneously, analysts, industry experts, and various media outlets release optimistic expectations, touting the sustainability of the trend and the significant upside potential of the currency pair, further amplifying market euphoria.

Once traders with long-term investment habits and short-term speculators lured by short-term profits have completed their positions and exhausted their funds, even if the market still has a potential trend, it will enter a consolidation phase due to a lack of new capital inflows. Those traders who followed the trend in the later stages of the frenzy, driven by greed, will ultimately become the perfect bagholders, bearing the losses from trend reversals or consolidation.

In two-way forex trading, only traders who can withstand fluctuations of 50% or even higher in losses truly possess the fundamental qualities of a long-term investor.

Currently, most global forex trading textbooks advocate the principle of "no more than 1% stop-loss per trade." While ostensibly a risk control standard, this inadvertently encourages traders to frequently enter and exit the market, falling into the trap of short-term speculation and significantly compressing profit potential. In fact, by adhering to a long-term holding strategy and avoiding emotional trading and overtrading, most traders could avoid substantial losses.

However, many self-proclaimed "long-term investors," under the sway of the so-called "value investing" philosophy, exhibit clear blindness—they do not base their decisions on in-depth research and systematic judgment, but rather follow the crowd, hastily jumping on the bandwagon when they see a currency pair performing strongly recently; in recent years, as the concept of "value investing" has gained widespread market acceptance, they have flocked to so-called "value investing," completely lacking the cognitive foundation and psychological preparation necessary to practice value investing. True long-term value investors must possess the psychological and financial resilience to withstand significant price pullbacks—including drops of 50% or more. This is especially true in typical long-term strategies like carry trades, where the determination to hold positions long-term and navigate cyclical fluctuations is crucial. This "long-term struggle" is not passive waiting, but proactive adherence based on a thorough understanding of the macroeconomy, interest rate differentials, and market cycles.

Furthermore, long-term investors should consciously reduce their focus on short-term price fluctuations and cultivate a "no-watching" mentality. Excessive attention to real-time market data is not only unhelpful but can also easily induce irrational trading. It's important to understand that no long-term investor can accurately determine whether an entry point is at an absolute low; even seemingly undervalued currency pairs may decline further due to market sentiment or external shocks. Therefore, once valuations are confirmed to be reasonable or even low, decisive action should be taken—because the cost of missing out on an entire investment opportunity is far higher than buying at a "suboptimal price."

In the two-way forex trading market, the ultimate goal for the vast majority of forex investors is long-term investment, and the core of long-term investment is value investing.

From the perspective of investment awareness, very few forex investors establish a value investing philosophy when they first enter the market. Many haven't even heard of the professional term "value investing" during their initial learning phase. Their initial trading exploration often focuses on various technical indicators in trading software, typically starting with basic technical analysis, diligently studying candlestick patterns, moving average systems, and other technical indicators' application logic, attempting to capture short-term exchange rate fluctuations through technical analysis to generate trading profits.

However, forex investors often encounter a core dilemma in the initial stages: even after systematically learning various technical analysis methods and mastering the application techniques of different indicators, they frequently make decision-making errors in actual trading, resulting in volatile "profit and loss" patterns. They struggle to achieve stable profits and are constantly caught in the back-and-forth between gains and losses, failing to achieve expected returns and instead suffering from the psychological pressure of market fluctuations, becoming mentally and physically exhausted and trapped in a cycle of trading inefficiency.

The turning point for forex investors towards value investing often stems from this long-term market experience and trading inefficiency. When investors have experienced enough setbacks in the market and been tormented by the uncertainty of short-term trading to a certain extent, they will be more likely to relinquish their obsession with short-term gains and attempt to understand and recognize the core logic and trading system of value investing when a peer or experienced trader mentions the concept. In this transformation, investors who actively learn from the mature experience of seasoned traders will find that the vast majority of traders who have cultivated the forex market for many years and weathered market cycles eventually shift towards long-term and value investing. The core reason is that they are tired of the constant torment caused by short-term exchange rate fluctuations and yearn to escape the "constantly monitoring the market and experiencing anxiety" trading environment, seeking a more stable and sustainable trading model.

The core operation of value investing in the forex market lies in selecting high-quality currency pairs and holding them for the long term. Investors need to consider key factors such as global macroeconomic trends, differences in monetary policy, and exchange rate valuation levels. They should enter the market when currency pairs are in an advantageous valuation range, maintaining sufficient patience and composure when facing short-term pullbacks, not letting short-term fluctuations interfere with their judgment, and being able to tolerate the time cost of long-term holding. Once the exchange rate breaks through key ranges and enters a trending market, they should abandon the traditional logic of short-term stop-loss orders and instead lock in profits through profit-taking or hold long-term to share in the long-term gains from the trending exchange rate increase.

The core advantage of this value investing model lies in its ability to restore rationality to trading and normalcy to life. It frees investors from the anxiety of constantly monitoring the market and living in fear, eliminating the need to excessively expend energy on short-term exchange rate fluctuations. Investors can eat and sleep well, maintain a healthy lifestyle, and approach market volatility with a more rational and composed mindset, achieving a balance between trading and life.

It's important to clarify that value investing represents the highest level of investment in the forex market. Its core logic and operational discipline require long-term practice, trial and error, and experience in the market. Investors who haven't experienced a complete market cycle and lack sufficient trading experience will find it difficult to truly understand the essence of value investing, let alone implement its operational system. This is the core reason why forex trading novices often struggle to grasp the concept of value investing—understanding and practicing value investing is never something that can be rushed. It requires years of market experience, accumulating sufficient trading experience, and even two or three decades of dedicated cultivation and reflection before truly understanding its core principles and ultimately proactively embarking on the path of long-term and value investing.

In forex trading, there's no absolute right or wrong in adding to positions on breakouts or pullbacks; they essentially reflect different trading philosophies and risk preferences among investors.

Some forex traders tend to "add to positions on breakouts," believing that as the trend gradually solidifies, adding to positions in the direction of the trend helps amplify profits, especially in a clearly trending market. These traders are typically speculative, not fixated on absolute price levels, but highly focused on their account balance, strictly adhering to the principle of "trading based on capital," emphasizing a dynamic balance between position management and risk control.

Another type of trader prefers "adding to positions on pullbacks," aiming to average down their holding costs by adding to positions at lower levels, thereby achieving higher returns when prices rebound. However, this strategy requires substantial capital reserves; traders need to reserve sufficient funds to cope with the need to add to positions during sustained pullbacks. More importantly, the timing for adding to positions should not occur after a price breakout, but rather after the market enters a relatively undervalued area—after all, no one can precisely pinpoint the "lowest point." The so-called advantageous price is actually a relative value range, requiring a comprehensive judgment based on technical analysis, fundamentals, and market sentiment.

In general, both methods of adding to positions have their advantages and disadvantages, suitable for different market environments and trading styles. Breakout adding focuses more on short-term trend capture and profit efficiency, while pullback adding reflects a belief in long-term value reversion. Traders' choices should not be based on the inherent superiority or inferiority of the method itself, but rather on a deep understanding of their own market perception, risk tolerance, and investment philosophy. Ultimately, the key to success in forex trading lies in the consistency of strategy and philosophy, not in the correctness or incorrectness of a single operational method.

In the two-way forex investment market, for investors participating in trading, if they can abandon the speculative mentality of getting rich overnight, trading itself is actually a set of rational operational logic that can be followed and implemented, not a complex and difficult-to-understand game of chance.

In reality, many forex investors, regardless of whether the market is consolidating or trending, are obsessed with pursuing annual returns of doubling or even several times their initial investment. They often try to achieve profits of hundreds of thousands or millions in a short period with tens of thousands of dollars in capital. Such expectations, detached from market principles, are difficult to realize. Forex investors, if they cannot relinquish their speculative obsession with quick profits and exorbitant gains, it will be difficult to build a stable long-term trading system, let alone achieve consistent profitability.

In two-way forex trading, one of the core principles is "better to earn less than to suffer huge losses." A significant loss not only wipes out the investor's initial capital but also directly interrupts the accumulation of compound interest, which is crucial for snowballing returns in long-term forex investing. One of the core logics of the forex market is that profit and loss are two sides of the same coin; an investor's expected return is always directly proportional to their risk tolerance. Pursuing higher returns inevitably involves taking on higher risks, while reducing risk exposure means appropriately lowering return expectations. There is no absolute opportunity for high returns with low risk.

Even when established forex traders share their mature trading experience and rational understanding, investors with a gambler's mentality often find it difficult to accept. These investors' core motivation in forex trading is always quick riches and the realization of their so-called "wealth dream," ignoring the objectivity of the market and the rational nature of trading. They are unwilling to accept the core logic of "slow wealth," which is the underlying truth that persists in the forex two-way investment market.

In forex two-way investment, long-term investment often has an advantage over short-term trading for investors.

Importantly, each forex trader should choose an investment method that suits their own circumstances, rather than blindly following others' advice or simply following a trend because a certain method seems to be profitable.

Specifically, working professionals are usually not suitable for short-term trading that requires frequent monitoring due to time constraints. While short-term trading offers many opportunities, similar to playing mahjong, there are opportunities almost every day; long-term investment, on the other hand, is more like waiting for a goat to appear, which may take several years to find a truly exceptional opportunity. Therefore, short-term trading requires investors to possess superior analytical and rapid decision-making abilities, while long-term investing demands relatively less of these abilities but requires considerable patience and unwavering confidence.

In terms of returns, short-term trading may yield small but frequent profits, but it can also lead to losses due to misjudgments, much like wasting a lot of "ammunition" when hunting sparrows. In contrast, long-term investing, once an opportunity is seized, can yield substantial returns, like successfully hunting a goat.

For traders who wish to engage in both short-term and long-term investing, it is recommended to use a split-account approach, allocating funds to different strategies. Long-term investment accounts can focus on carefully selected currency pairs or carry trades, which emphasize long-term holding and confidence. Short-term trading accounts are more suitable for currency pair trading driven by short-term news events.

Finally, while using sparrows and goats as metaphors for short-term and long-term investing is meant to illustrate the differences, one should not fall into the extreme mindset of "fearing the goat will never come." Each investment method has its applicable scenarios and value; the key is to find the investment approach that best suits oneself.

In two-way forex trading, short-term trading can easily cause substantial damage to the career development of working professionals.

Profits from short-term trading can easily tempt investors to abandon their regular jobs; losses often lead to low morale and impaired work performance. This cycle of "winning leads to complacency, losing leads to despondency" not only makes sustained profitability difficult but can also evolve into a high-risk, low-return negative-sum game, with behavioral patterns highly similar to gambling.

In essence, short-term trading demands extremely high levels of technical analysis, market sensitivity, disciplined execution, and time commitment; it is essentially the domain of professional traders. For ordinary working professionals to participate as amateurs is tantamount to challenging a highly specialized market with non-professional skills, with extremely low odds of success. Even more alarming is that such trading can not only lead to financial losses but also cause emotional fluctuations that interfere with their primary work, resulting in a double loss.

Therefore, forex investors with stable jobs should be keenly aware of their strengths—the professional skills and long-term value accumulated through deep cultivation of their core competencies far outweigh blindly chasing short-term fluctuations in the forex market. If there is a genuine need for forex investment, it is crucial to abandon a speculative mindset and adopt a sound long-term investment strategy, treating trading as a supplementary means of asset allocation, not a primary source of income or a sense of accomplishment.

In the two-way forex trading market, the core key to long-term profitability lies in a trader's ability to truly master the art of loss, steadfastly hold positions within floating loss ranges, and adhere to their trading logic.

This is akin to adversity in life; adversity itself is a hardship, but it is also a necessary experience that forces traders to break through cognitive barriers, refine their trading systems, and achieve skill growth.

In forex trading, the difficulty of recovering losses exhibits a significantly non-linear increasing characteristic, which is one of the core risk features of forex trading. When an account loses 20%, a trader needs a 25% profit to break even. If the loss expands to 50%, a 100% profit is needed to cover the shortfall. And once the loss reaches 80%, a 400% profit is required to recover the initial capital. This data vividly highlights the importance of controlling the magnitude of losses in forex trading.

Many forex traders are not lacking in profitability; in actual trading, they often seize profit opportunities arising from market fluctuations. However, they ultimately fail to achieve long-term stable profitability. The core problem lies in the lack of ability to control losses and avoid large drawdowns, and the failure to establish a sound risk management system. This leads to a single large loss wiping out all previous profits.

In forex trading, risk control is the core competency that transcends all other trading skills. Its importance far surpasses the ability to capture market hotspots and predict short-term market movements. It is the fundamental guarantee for traders to achieve long-term survival and sustained profitability.

In forex trading, the entry point is not a precise point, but rather a range. Understanding this prevents traders from obsessively pursuing the so-called "perfect" entry price.

Trying to find the most precise entry point often leads to unknowingly falling into the trap of trying to buy at the bottom or sell at the top, and it's difficult to realize it.

In fact, regardless of whether technical or fundamental analysis is used, the core secret to profitable forex trading always lies in strict money management and effective risk control.

Technical indicators and news are important, but not decisive factors—many successful traders achieve consistent profits without relying on these tools.

Ultimately, the key to sustained profitability in forex trading lies in establishing a trading system centered on money management and risk control.

In the context of two-way forex trading, a trader's cognitive advancement and mental maturity are essentially a long and challenging process of enlightenment—a path of transformation that most market participants find difficult to achieve.

Regarding the dialectical relationship between knowledge and action in trading practice, and the pivotal role of "enlightenment" within it, there has always been a divergence of opinion within the industry: one view is that knowing is easy, but doing is difficult; the other view is that knowing is difficult, but doing is easy. Different traders, based on their individual trading experiences, perceive the difficulty of knowing and doing very differently. Some feel that the constraints and temptations at the execution level are difficult to overcome, while others believe that building a fundamental understanding and trading philosophy is the biggest bottleneck.

A trader's cognitive transformation often accompanies the accumulation of experience throughout their trading career. Most people initially find adhering to discipline and overcoming human weaknesses more difficult than trading in the early stages. However, with accumulated trading experience and repeated market trials, they gradually realize that true understanding and the establishment of underlying logic are far more challenging. Those traders who consistently find execution difficult often possess only a superficial understanding of trading rules and market dynamics, mistaking superficial knowledge for profound comprehension.

From the perspective of the composition of trading cognition, "knowledge" itself encompasses two dimensions: superficial understanding and deep insight. Superficial understanding includes external knowledge systems that can be learned and transferred, such as trading philosophies, technical methods, and risk control rules. Even mastering this part requires a significant investment of time and energy, but most traders tend to dabble in it, acquiring only a smattering and believing they have grasped the essence of the market.

In contrast, profound enlightenment is an internalized, ineffable inner cultivation—a deep insight into market dynamics, human nature, and one's own mindset. This process cannot be taught by others; it can only be sought inwardly, entirely dependent on the trader's own mental refinement and self-awakening.

Achieving enlightenment requires continuous practical experience. Traders need to constantly put their learned concepts and methods into real-world testing. Regardless of whether the trading result is profit or loss, they must accumulate genuine market perception in every operation, extracting insights from the feedback of gains and losses and the fluctuations in their emotions, gradually achieving the integration of theory and practice.

True knowledge in the trading field always stems from hands-on practice. Only by repeatedly applying each point of understanding to real-world scenarios, refining and perfecting it through market testing, can one truly deepen and internalize their knowledge, ultimately reaching the state of enlightenment.